How the Economic Sausage is Made

How Inflation, Exchange Rates and Cheap Debt Helps Your Investment Portfolio

The world economy is far removed from the free enterprise system it claims to be. Ironically, the Transatlantic Slave Trade of the 16th-17th century more closely resembled “free trade” than the mixed economies of today. The basic principles of economics are laws of nature. These laws have been distorted by the world’s collective worthless currency and debt-based financial system. A true free economy relies on stable money for transacting and a market derived rate of interest that supports the purchasing power of that currency. We have neither… The world is plagued with fractional reserve banking which facilitates wealth gaps between nations and inflationary economies dependent on insolvent governments. To understand how the sausage is made is to ensure that YOU are on the right side of the equation. The other side is poverty.

An economy is defined as an amalgamation of related production and consumption activities that determine a fair price for scarce resources based on factors of supply and demand. Simply, it’s a diverse exchange of buyers and sellers. The textbooks define the state of modern nations as a “mixed economy”. This is free market principles combined with government-imposed controls to ensure economic stability. In reality, we have fiat (fake) based economy that contorts the laws of finance with exchange rates, central bank imposed interest rates, and insane levels of debt backed by nothing. Because of this, global resources have different ratios of supply and demand where “rich” nations are buying actual goods from “poor” countries with valueless money created out of debt. The slave trade at least had a fair exchange of goods with inherent value.

Compounding Your Face In

The countries of the world may only engage in international trade if they subscribe to the enslavement… I mean subservience… I mean the privilege of the global central banking system. Central banks cemented themselves as the indisputable financiers of the world in response to the inability of governments to tax their way through various wars. By privatizing currency issuance, governments were able to print cash out of thin air to fund any venture, regardless of public acceptance. This formally replaced real money with interest bearing debt. Political leaders who stray from the pack meet similar ends ranging from ill historical treatment to brutal deaths. That is sensitive topic for another day, google at your own risk of radicalization. Nevertheless, each country must subject itself to indentured servitude in the form of fiat currency or be punished with economic sanctions or potentially war.

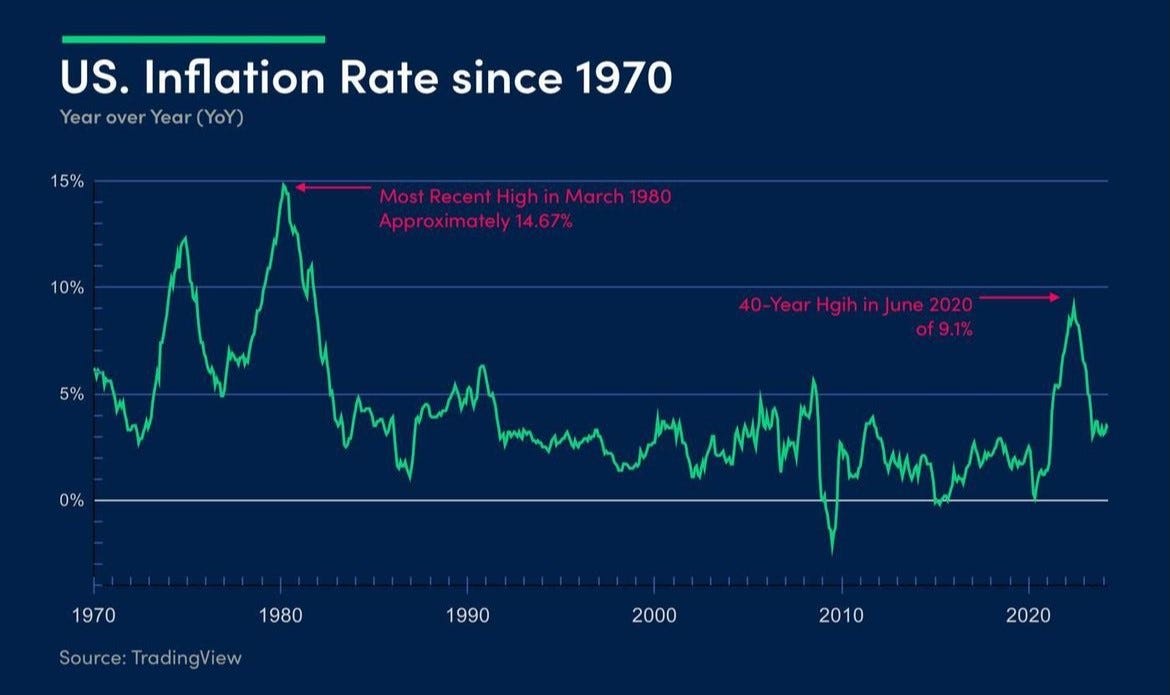

The interest needed to service all this debt is precisely what creates inflation due to the following principles:

The money supply must constantly increase to cover the interest incurred on all the expenses of a nation that isn’t paid with taxes.

The money supply needs to have a positive correlation to the production of all goods and services to maintain its value. Failure to do so causes inflation or deflation of purchasing power

Debt should carry a high burden to motivate increased production or the abstinence of indebtedness altogether. Low rates can incentivize irresponsible lending.

The debtor should assume risk of nonpayment to ensure appropriate financing and to incentivize production level equal to the obligation. Central banks are the “lender of last resort” and can simply print cash, so they have no risk.

Central banking destroys these principles because the money comes from nothing, the rate of interest is determined by the bank, and the repayment is guaranteed by governments who can simply incur MORE debt. There is no risk assumed by the debtor and no additional value created to positively correlate with the increase in money supply.

The result of course is endless currency devaluation and the subsequent price inflation. This can come in many forms unrelated to the cost of consumer products. ALL markets, including those for essentials, are subject to the laws of supply and demand. That’s why the rate of inflation significantly lags the actual increase in the money supply. The price of eggs and gasoline can only increase at rates consumers are willing to pay. Eventually anything can become too expensive before people find substitutes or broadly refrain from purchasing altogether. However, speculative assets like stocks and real estate have NO limit in their price appreciation. The excess of money in any economy will inevitably find a home among a diverse set of assets. This is why the stock market and housing seem to defy the laws of demand and price discovery.

Printing Cash with Home Equity and the Japanese Yen

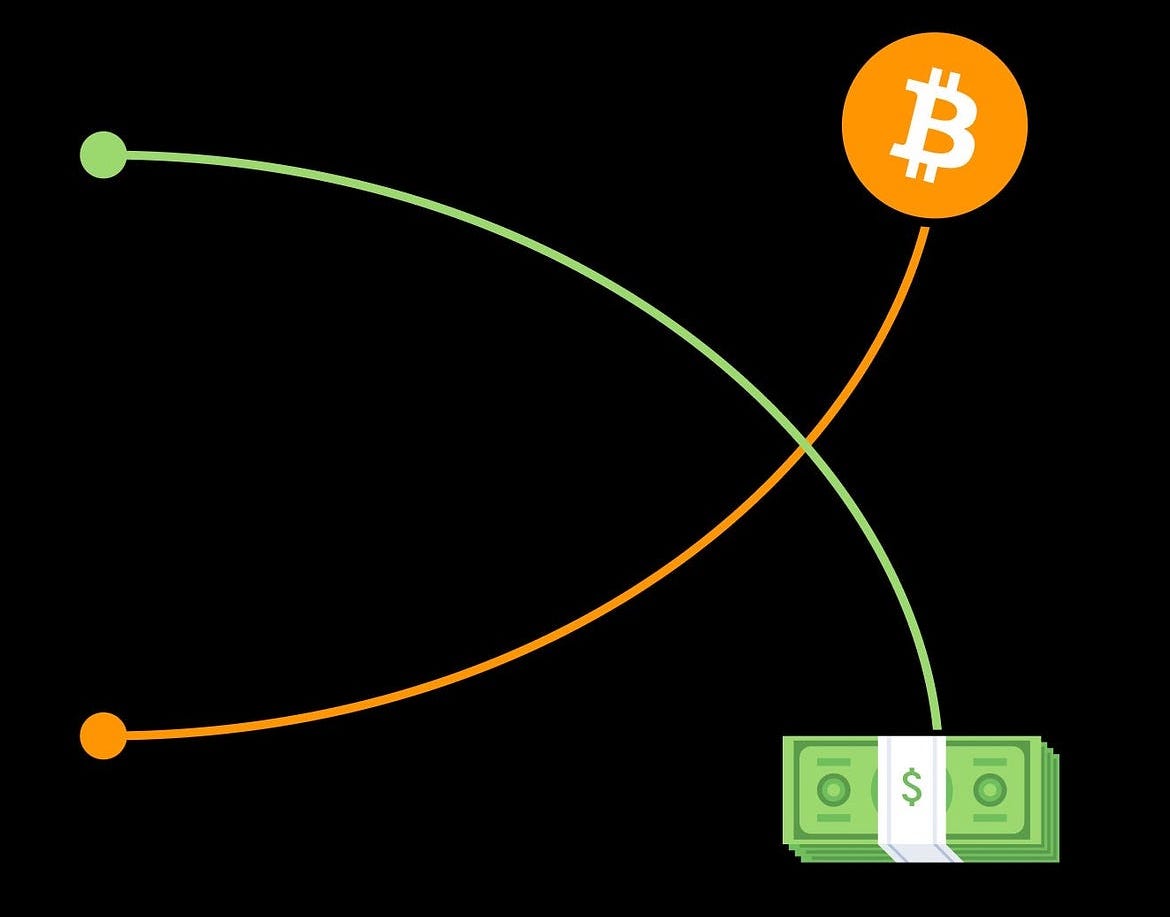

Financial literacy is a privilege that many people never possess because it requires an understanding that the whole system is inexcusably rigged. The money is fake, governments become increasingly insolvent, and banks must ensure that the fake money finds its way into speculative assets rather than essential goods. Their preferred method of confidence is manipulating exchange rates between fake currencies to make goods artificially cheaper. All the currencies of the world are worth the exact same… ZERO! The exchange rate is determined by preference for natural resources and labor, as well as the manipulation of interest rates to favor multinational corporations who produce in one country and sell in another.

For example, if a corporation were to borrow money in Japan at a rate of 1% interest and then purchase a U.S. Treasury that yielded 2% interest, they would be granted a profit for doing nothing. Then that corporation would purchase raw materials in Zimbabwe, a country that devalues their currency in exchange for cheap loans by other central banks. Those resources are transported to Mexico who can produce goods with cheap labor before selling those goods in America for U.S. dollars. The profit from their financial instruments would cover the additional cost of logistics while they benefit from the exchange rate between four different nations. Technically everyone benefits in the form of favorable debt, jobs, trade, or profitability. The underlying issue is the varying level of gain for each nation widens the wealth gap and further devalues every currency as the main contributor of value is derived from debt instead of productivity.

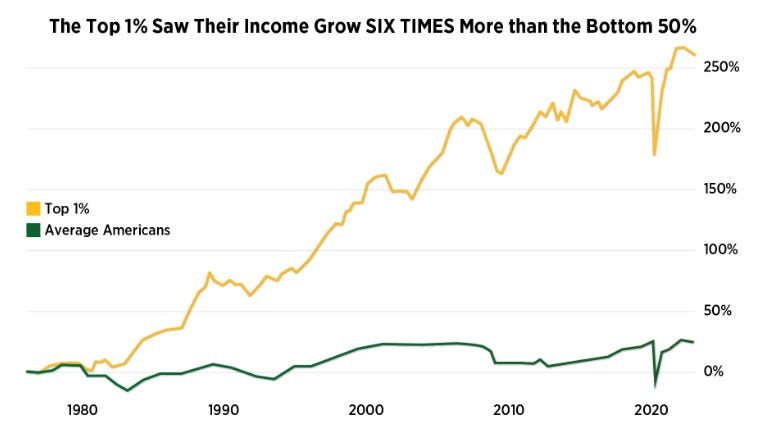

The mechanism is the global financial system is DESIGNED to create inflation. The swapping of currencies, foreign offshoring, and central bank debt collectively pushes more money into financial assets instead of real productive capabilities. The real bag holders are those who save their money rather than investing it. The stock market (in aggregate) is always supposed to go UP in relation to the failing currency. This of course favors asset holders, particularly the top 1%, at the expense of the poorest individuals.

Your home equity always increases because it is in the best interest of the financial institutions for you to utilize that “equity” for more loans even though it does not actually exist. Your home is ONLY worth what someone else is willing to pay for it. If a meteorite destroys your home tomorrow, the equity that the mortgage lender says you have means nothing.

Now You Know

Look I don’t like it either, but that doesn’t mean we cannot profit from these financial fallacies while they still exist. The value of currency is purely backed by CONFIDENCE in the governments that issue them, which is turn backed by the CONFIDENCE of those governments to pay their debts with taxpayer money. If you believe in America, then you believe in the dollar. This system, with all its faults, could technically go on forever if there is trust from the constituents of each nation. Obviously, there is an alternative in the form of actual free markets in local economies. Money could return to a commodity backed standard. Fair trade between nations can return with liberated nations and value-based finance. There needs to be a will before there is a way. Until then, let it ride.